Pictograph of One Day Wonders

First, my beloved readers, I must apologize for the turd-throwers at Yahoo screwing up my blog. A few days ago, they announced a free quote/chart module which I decided to put on the blog. I added it yesterday, and it didn't change anything. So I guess their side wasn't working. Today it starting "working" and completely hosed the format of my entire blog. So, umm, I've nuked it, and I shan't be using that again! Idiots.

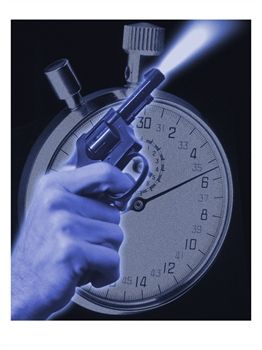

I'm delighted to see that yesterday's madness was yet another one hit wonder. Allow me to express my view of these sucker rallies in picture form:

21 comments:

Latest AAII survey shows 24% Bulls, and 58% bears. Last time we got a -34% difference was Feb 2003, and before that October 1992.

Such overwhelming pessimism is rare, and invariably signals important bottoms.

LOL, great post Tim

It doesn't invariably signal important bottoms at all. There have been many examples in history that bearishness actually preceded down markets. Contrarian indicators are not always reliable, because the assumption is that the public is ALWAYS wrong. There *is* no 'always.' Oh, and I hope GOOG gets nuked tonight. That would be sweet.

goog to 350 if it misses

if GOOG by chance falls to 330-340 might try and buy a few shares AH only for a swingtrade. Could easily swing 10-15 points off of the 330-340 if it does go there later on. I remember a while back it dipped like crazy AH only to come back up.

lol

Today was a great day to load up on DIA!!!

(puts)

hurricane5 --- is that $600 target on GOOG after a reverse split??

another reason to short the bejesus out of yahoo yesterday....

NICE follow through you degenerate BULLS!!!

Hey Bears! need your help --- has anyone come across research that explores gaps on charts, and more specifically that "all gaps must be filled"? -- appreciate any help on this, and on that note have a look at AAPL!

-Frank

Tim,

Thanks for the heads up on the OIH prospective H&S formation. I shorted DO this morning and it was down huge. I have a question for you, when you see an etf with a certain pattern do you like to trade the etf or the constituent elements of the etf. In the case of OIH would you buy puts on OIH itself or buy puts on BHI, HAL, RIG, SLB, GSF, BJS, DO, or NBR.

Thanks,

Pete

Wow, did I call this one wrong. I thought for sure the Dow would be at least 50 points in the green today. The Naz gave back EVERYTHING today. The Dow fared better, but still gave back a good portion of yesterday's gains in steady, seller-dominated action. There was no hope of recovery today for the blue chips.

A REALLY pathetic follow-through from yesterday. The sellers must have really coordinated their efforts yesterday and sat on the sidelines in unison. Today they came out and took advantage of those buyers yesterday.

Congrats to the sellers today for holding out yesterday. I must admit that I misjudged today's action. But if the sellers can coordinate their efforts tomorrow and hold back, they might trap some bulls yet again. One day up, next day down, one day up, next day down... by coordinating like that, the sellers can really scale out of their positions without losing much on the way down.

You could see this type of action on a smaller scale with UNH when it was topping around $64. The big money was selling in an orderly fashion.

It's like the party's over and the last one left gets stuck with the check.

-Tony

speaking of UNH, it was right at a downtrendline the other day. looked like a good short. oughta teach me not to trade before earnings.

Thanks Tim another slam dunk!!!

Hi Pete,

I was pleased with the action of the OIH and all the oil service stocks today. I'm long puts on OIH *and* a lot of the component issues. I think they've got a long way down to go, yet.

- Tim

Agreed. After the huge gains yesterday, a pull-back today was inevitable.

GOOG and MSFT both up big after hours after posting stellar numbers.

Sweet!

Regarding the "wild" market action:

GOOG was down to $360 after earnings was released today.

It then moved steadily back to $400 within about 15 minutes.

Now it's back to $392.

Definitely NOT a sign of a healthy market.

bsi87: I don't think anyone's being "premature" here. At least I'm not. I called for a follow-through day today, but clearly I misjudged the whacky market. Yes, a pullback was in order after yesterday's record gains, but today's action saw a steady stream of big sellers heading for the exits. There's no way to spin that into a "pullback day."

Does that mean that it's all down from here? No way! It's just too tough to call at this point. Could be up big tomorrow, could be down big tomorrow. I agree about the support levels. I'm not going long nor short here. Just watching the action. If the upper resistance lines in the major indices push back the buyers, then I will most definitely take out some shorts, at the very least go long on DXD, QID, MYY and SDS. And if the support levels are broken, time to pile on the shorts.

Too bad they don't have a small-capper double short ETF. That would be SWEET!

-Tony

GOOG under pressure today....

The earnings were good BUT I heard smaller margins on the conference call, plus more spending, and then there is a weakening economy.....

Nice pump job on the CC.

Notice the close today under the 50/200 day MA ..... tomorrow should be interesting.

I think I would wait to go long on this stock....technically I think it smells badly....

If the DOW goes up some more, then I'll be getting more puts. Otherwise, I'm pretty happy with what I have now, all the Aug DIA puts from 104-111.

I think the top of the DOW action on Friday through mid-week will be ~11070, much more and it could be a short-term problem for the bears.

I have an interesting line to me from the high of 7/6 tracking down through the open of 7/7 & 7/12 and the intraday action used it initially as support, but in the end of the day it ended with that line being resistance and faded down from there.

Another line I have is a Fib line @ 10927 (I didn't note the high/low it came from) that it almost closed at today. The next one up is the 11070. And speaking of Fib lines, the 61.8% for this recent high/low is the high for today and yesterday @ 11037. If it heads down tomorrow, it will likely bounce up from 10900, if a bounce will happen.

If there isn't another small rally to get it up to 11070, then this is definately a bearish h&s.

bsi: Thanks for the reminder on the rally confirmation days. I agree 100% that I just don't see how we can break out from here. It just doesn't seem logical.

One indicator I love is the NYSE Summation Index. Check it out here:

http://stockcharts.com/charts/indices/McSumNYSE.html

Notice that the market generally fails to rally when the index is below 0. It's still below 0 and got pushed back a bit today. This "rally" may take us near 0 in the short term, but I don't ultimately see us breaking above 0 this year.

Seems like a simplistic indicator, but for a good all-around feel for the broad market, that one is tought to beat.

I may start taking out some shorts on the oil stocks that Tim mentioned on Monday if the market attempts to rally tomorrow and nothing horrific happens to spike the price of oil over the weekend.

Good luck everyone.

-Tony

Tim I enjoyed your photo representation of Wednesday and Thursday market action. It seems the best play of late is to short every time the dow has a big up day and your bound to make money.

Post a Comment