Midnight Posting

It's approaching midnight here in Palo Alto. In less than six hours, they're going to report GDP numbers, and supposedly they will give the market a reason to go either up or down. Very few people will read this before those numbers are released, but I'm posting this new entry anyway.

Based on the charts I'm seeing, I'm predicting a down day, and I'm doing it without the benefit of those figures. So I'll either look like a jackass or a jeanyus. Either way, it'll start with "j".

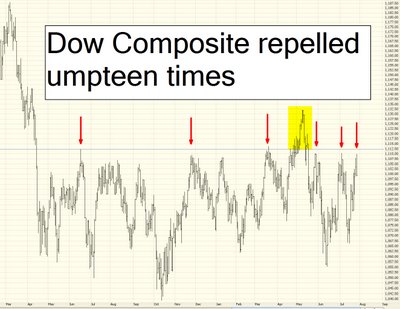

The Dow Composite looks ready to get pushed back away from its resistance line. When will the bulls ever give up?

The Dow Jones 30 had its second doji in a rowing. Can you say spinning tops? I also have drawn another (smaller) Fibonacci retracement, this one spanning from the May top to the ~10,650 level we keep bouncing away from. Interestingly, today marked the 50% retracement point. Coincidence? I think not!

I haven't bothered putting up a NASDAQ chart in ages just because this poor index is so battered and bruised, it's hardly worth looking at. But we clearly see a steady progression of lower lows and lower highs. Which is the very definition of a (loving sigh) bear market.

The S&P has done a great job staying underneath the medium-term resistance line, and it seems to have run out of gas. It fell today in a lovely bearish engulfing pattern.

A few days ago, I mentioned the Transports were probably done selling off. Boy, was I wrong. This index has sold off harder than any of the other major indices in the past few days. It is approaching major, major support right now. If it cracks the trendline and Fib retracement, wow, I don't know where it's going (except down).

Have the Dow Utilities made a double top? This is the only index with strength over the past month, but it backed off without making a new high today.

Gold also seems to have turned 'round.

Well, I'm going to walk the dogs. See you in the a.m.

49 comments:

Wondered what you were thinking when you commented that you thought the transports were done--still look like they have plenty of room to the downside to me. The double top doesn't "resolve" until the 3700 - 3800 area, although it'll probably get a technical bounce back up to 4387 or so first. At any rate, the group has been among my most profitable shorts! Have a good one.

10 minutes to GDP ....

Well GDP is slowing @ 2.5 % but the inflation PCE is still up. The feds main worry should be the inflation numbers. the Inflation guage just ticked up the highest in 12 months. Now, I agree the BULLS are morbid folks willing to buy on anything they see as the fed stopping. I also don't believe the numbers 100%.

Economy Slows Sharply, Inflation Heats Up ????????? rally ? ha ha

those fools at cnbc said the fed is now done and should not raise rates at the august meeting based on todays GDP, are they stupid or something. They have been wrong about 11 times so far thinking the fed was done in 2005, can someone please tell thos talking heads that the federal reserve is going to raise .25 on august 8th and bring the fed funds rate to 6% by early 2007. When will cnbc shutup. I put them on for entertainment but some there nonsense just gets me crazy. There stupid questions and there stupid opinions.......

I think the market rallies today somewhat based on lower GDP numbers, remember bad means good and good means bad. Dont know how long before a low GDP number becomes bad, I guess after 2006 is over and everyone knows that the economy is slowing to a crawl.

Anyone who really believes the future depends on whether rates hold or go up by .25 either in Aug or at another date, is so far adrift of reality. There are so many other economic factors and world political factors that all have the potential to implode on the US, that to suggest life revols around a .25 rate rise is totally niave to say the least

hahaha look at this ralllly, this is pathetic,,,,realllllly realllly pathetic...is this on the basis the federal reserve may pause and not even raise rates based on todays gdp, this truly fu&^ing pathetic....

greetings. I'm a relatively new trader so have not posted, but have been happy to simply read the entertaining banter.

today however, being most definitely a bear, I am appalled by what looks like a rally in the making (short term although it may be). The economic growth gets cut in half and as of right now we're $9.38 up in only 15 minutes? Have these people never taken an economics course? This is not good news!

BUY, BUY, BUY!!

are they just super optomistic, and we're the sadly jaded? i hope not. i like to think of myself as having hope for humanity overall, just not too much hope in their economic prowess...

either way, my puts look like cr@p today... =}

costas if the dow touches 11250+ and nasdaq 2100+ before the 8th meeting i think it will sell the news if a pause do comes into play....it will certainly priced in...

if there is no raise and a pause the market could easily put in a 2-3% rally, after that i think the selloff would begin...

again the whole pause thing is completly foolish, that is the reason behind todays rally, that the fed "MAY" pause. The dow could break the 11256 tim has been talking about and if so before the 8th meeting the dow could easily rise to 11350-11400 without a problem. However I think this will only set up the markets for even a bigger selloff towards the end of the year.

This rally is a joke....someone really must be kidding. Did I not just see higher then expected CPI/PPI.... and now we have slowing growth.... STAGFLATION. You don't have to be a genius to know that this is really bad for stocks.....

When thing get ugly in the next couple months..... there better be no whining.....

I just bought some DIA puts....

this is ABSURD, but it is what it is.

its crazy, seems how quickly everyone forgets about the massive sell-offs. This is probably the only summer i can remember with this much volatility. Up 145 down 85 down 101 up 220 down 65 down 120 down 45 up 275. ITs crazy. Nasdaq easily moves 1-2% a day without a problem.

agree with dave, this is just to trap in more buyers, however the dow and nasdaq could break out next week, if this is the case dont add any positions and wait for the news august 8th because its going to one heck of a ride.

some etfs i follow are moving to levels not seen in months here are just a few

EWZ

EWW

EEM

ILF

EZA

pb the dow goes to 11300+ before the fed meeting and its all baked in like a fresh apple pie....

Folks, I think everyone is misreading the three huge "selloffs" that we experienced. They were caused 100% by the draining of liquidity from the market due to manipulation from the Bank of Japan. That's the ONLY reason.

I think people have to look at those selloffs in a special context as a result. I honestly don't think the sentiment has changed all that much between April and July. People are still very much in the bullish camp, GENERALLY SPEAKING.

I don't think we'll see a significant downturn in the market until people really turn bearish. And with oil coming down, the bond market rallying, and a slowing economy coming into focus, I think people are looking at "fundamental value" of stocks and deciding that they're not totally out of line.

As I've mentioned plenty of times before, the P/E of the S&P and the Dow are NOT out of line. They may be edging towards the high side of traditional valuation, but they're not outrageous. So I wouldn't necessarily call the bulls "stupid" for buying at this point.

That being said, if the market does turn decidedly bearish, we could quite easily expect a 25-30% haircut in the indices within the next year.

I do agree that any overextended rallies should be heavily shorted. I just don't see that being the case quite yet, although today's rally is a little excessive, I must admit.

-Tony

Is anyone looking at any good short setups that may show overbought situations?

Aside from DXD, QID, and MZZ, I'm not quite aware of many other good trades to enter when the tide turns bearish.

Thanks for any help.

tony have to disagree, I think the markets will sell-off just like they have been after huge run-ups, this market is extremely volatile at the moment and any huge rally or any huge decline of 1-2% should be taken with a grain of salt. This will continue for quite sometime with no immediate direction. As quick as the dow went from 10700 to 11200+ it could do the same from 11200 to 10700 within a 2-3 weeks. This volatility will keep everyone thinking of which direction is this market actually heading. I think it trades in a tight range og 500-700 points. I just hope that if the dow does get back to 6 year highs stupid cnbc isnt cheering it on like they did last time when it was about 80 points away, everyone knows what happened. They had that stupid pathetic looking box on the top of the tv screen that point how the dow was from all time highs....

you missed SDS out of MZZ DXD and QID....WOuld be buying DXD at dow 11350-11400..

Someone on this blog said trade what you see not what you want the market to do!! Words of wisdom. Chronictown

I see a bunch of morons wanting to die! Why trade that?

- Frank the Tank

Every one of the ETF's mentioned by (another) "anonymous" earlier have major resistance just overhead. Too soon to be declaring a bullish victory there.

EWZ

EWW

EEM

ILF

EZA

It's like the reality is starting to set in, the last hour in a word, waffling.

this is ABSURD ...... SO ABSURD.

the market appears toppy but I think my BEAR days are very numbered. F this.

thoughts on shorting AAPL --- it enterring into slightly over-bought territory

this is ridiculous, naz inching towards 2100!

naz could be at 2150 next week, i was long QLD but decided to switch brokers and in the process it takes 7-10 days so to protect my portfolio i went long QID so that if there were any down days i could protect my portfolio from steeper declines well here i am down on my QID position and up on my QLD position, what perfect timing. But my portfolio is still about even so when im able to trade ill take my profits in QLD and keep my QID for the next huge decline, may add to my QID under $70.

Lay out shorts on the indexes right here..... they are overbought. Look around for moves that don't make sense / no volume..... SBUX WFMI QQQQ DIA

This is a sucker rally at its best. Sucking people in before we plunge. The fed won't be stopping August 8, and we will be in overbought territory when it happens..... this is what all of us asked for a really good opportunity.

Lay the shorts on like mad. inflation/slowing growth = STAGFLATION= multiple contraction with equities.

who in their right minds is buying stocks now that the economy is slowing down and inflation is high?

agree if the fed raises and doest pause say hello to dow 10800 and nasdaq 2025

SMH up 8% from just 5 days ago!!!!!!!!!!

8%%%%%

I think if it does another jump i would be going short around 32.50

pb what did you long on??

last hour downfall?

Lot's of folks try'n to reason themselves into a short trade. There is too much emotions here.

Anon at 10:46,

yeah right! why don't you buy some QQQQs

how can anyone think we are going higher with too many negative things going on. The one thing that will bring these markets down is the slowing housing boom. For the last 5-7 years people have been borrowing against their homes adding plenty of money to this economy. 2/3 of this economy is run by consumers. With interest rates going higher and america in record debt where will money come from now to keep this economy going. Nothing, with the housing boom coming to a complete halt expect a slowdown and possible recession by mid 2007, by then im sure rates will be at an even 6% and the federal reserver will be most likely cutting rates to get the economy back on its feet....short away, dow 10500 and nasdaq 2000 here we come...

History shows us that what's "going on" has little to do with market direction-- at least beyond the initial jolt. We've rallied in times of crisis and tanked when things were good. When the market wants to trend up, not much stops it (good news is good news and bad news is good news) and when it is ready to go down, the reverse holds true. Tim is conspicuously absent this morning. You know, there's a chance we could still roll over into the close.

AMEX IS DOWNNNNNNNN THE AMEX IS DOWN...ALL TRADES ON THOSE POWERSHARE ETFS ARE ALL WRONG!!!

A rally is a rally guys (and girls). here's what technicals say:

- the dow and s&p have reclaimed major trendlines and broken intermediate downtrends (yet again).

- lots of MACD Histogram bullish divergences, they're everywhere, including most indices...the bears are worn out...for now.

- All my shorts have been stopping out the past two weeks...telling me something might be up.

- I saw the indices making new highs (even though they pulled back), and pushing hard against resistance.I went long yesterday, but cautiously with half positions. Glad I did!

I know there are some new traders (including myself) who read this board and I wanted to mention something. I've brought up some of the newsletters I get before, one from Glenn Neely (Neowave.com).

Glen has been dead on for the last 60 days or so in his short term predictions, calling just about every turn correctly in June and July. He started July out expecting a huge drop and when we were near the lastest bottom sent out an emergency note (I think last Wednesday) saying he had flipped his position and has gone long, despite the fact that we had not hit his lower targets.

Anyway, he wrote the following in today's email: "Due to the strength of this correction, the S&P should soon embark on its largest, fastest advance in years." More to the point I think he expects one more down correction to get the bears all charged up again, and then a huge move (> 20%) in a 3 month period. He indicated he doesn't think it's imminant (tomorrow) but sometime in the next few weeks.

Anyway, I am still personally on the fence. In posts earlier this week I indicated I thought it was likely we would rally to help with end of month window dressing for the money managers and we are now closing in on the key resistance levels and have temporarily paused. This week has played out as I expected. Also, everything is looking toppy again so I'm thinking that sometime soon we are due for at least one more leg down.

THe key for new folks who are following this blog (and foe me) is to be careful. If you think we are still in the bear market by all means buy the puts and/or go short as we may get a huge drop that some others are expecting. I know some think we could be in for a doozy of a drop. But, make sure you have good stops in place if the market does ultimately reverse as Neely is predicting in the next few weeks so the puts hurt you but don't wipe you out.

Mike

To Brian-- interesting, it's only my longs that have been stopping out. The shorts have been doing great overall. Few breakouts have worked, leadership is absent, and breakdowns are severe. A rally within a bear market can be strong-- and misleading.

costas1966:

Any picks for going long?

looks like the bear is killed by the idiots who are buying in this ridiculous rally!

I think the bears will be back in control once this mini rally is done with. I think the Dow heads back close to 6 year highs with the nasdaq going back to the 2150-2200 area right before the next big sell off which should start somewhere at the end of sept and probably follow through into November with most likely a small rally going into the end of the year. This the indices will end down to flat by the end of 2006.

puts = fucked.

there will be NO major sell off. no DOW 9500. Nope. The FED and the PPT are too involved in this market.

How ever we are hitting some resistance on most of the indexes.

SLOW GROWTH AND INFLATION. RALLY THE MARKETS ? LET ME GET MY LIPSTICK FOR THE PIG.

Resistant line can easily be broken during good earning quarter.

Look for intraday weakness industry leader and scoup it up, LVS and BBY for me today.

Leaders

Dow 11800 likely if cap the rate next month

DOW

Any opinion on GM short?

Thanks in advance

Post a Comment