Once More into the Breach

Well, I'm glad we got that bit of business out of the way!

The stock market did its usual spastic freak-out the moment the Federal Reserve Statement was issued. First it lurched down. And then up, big time. And then down again. And it spent the rest of the day generally heading south. It wasn't a plunge, by any stretch, but it certainly nuked a very healthy rise in equities into oblivion.

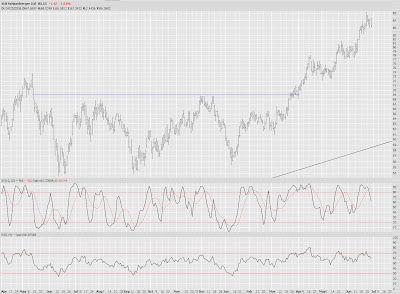

Looking at the candlestick chart of the IWM (which is the ETF for the Russell 2000), you can see a picture-perfect shooting star. My feeling is that tomorrow will be a down day, and we can get back to the business of shorting this market.

Colgate (CL) is a relatively stable/"no surprises" stock that might be worth acquiring puts against.

Coventry Health (CVH) appears to have failed to break out of a normally bullish pattern, which is bearish. I'm short the stock.

I've mentioned Jet Blue (JBLU) for the bulls out there. I stand by this position. Maybe this former high-flier is getting its act together after many embarrassing fumbles.

I bought puts on MCK today based on a small head and shoulders pattern plus a falling-away from a Fibonacci fan.

Oils are looking pretty good for put/short opportunities too. I bought puts on OXY just before today's close.

Same story with Southern Copper (PCU).

Potash puts are fairly heavily traded, thus the bid/ask spread isn't atrocious. I picked up some of these today (as with all the other trades, well after the Fed craziness).

...and the same for Schlumberger (SLB).

.....and Exxon (XOM).

I stopped trading Research in Motion (RIMM) ages ago, since the stock is just too weird for me to understand. Congratulations to those long the stock (and, even moreso, long the calls). RIMM had oh-my-God earnings after the close today and, last time I checked, was up 12%. Poor old Fred Hickey can't seem to live this one down.

49 comments:

Well, well, well

Today I did something really brave and.... The day looks like forming an "three outside up" pattern with yesterday forming a bullish engulfing daily chart. Mid-day, I figured that I would have to contribute to bring the damn market down, otherwise it looks technically so strong as it breaks away from the range and breaks 50-day MA. I pulled all my purchasing power to the OEX puts... when SPY was at 151.30, and sold all of them at the end of the day, with a profit of 75k. I CAN NOT BE HAPPIER!!!!!!!!!!!!!!!!!!!

Jiminy cricket - $75,000 on an intraday trade. You are the man! Congratulations if this is true. Right on.

Shooting stars are dandy, but you usually want to see a spike in volume to believe them.

"Shooting stars are dandy, but you usually want to see a spike in volume to believe them."

The IWM is so heavily traded each day, I wouldn't demand the volume spike. For a regular equity, yeah, I could see the logic in that. Anyway, as always, time will tell.

250 contracts of fast-moving OEX contract, yeah, right!

Like I said yesterday, there is no volume for ups. Lack-of-seller rally just has to dry up.

Now, RIMM is 193.50.... I guess RIMM is only part of NAZ 100. But even QQQQ is only up a penny after hours...

Ha!

Congratulation to CROX shorters...

My pick for shorts: SNDK.

It seems stuck on the 48.50 resistance.

NVDA is a little tricky, but worth looking

Tim,

Something can you share? Which software you use for the blog? I can hardly believe you did this through webpage. I am thinking of writing my own blog.

I have been patiently waiting for a spike due to the end of quarter markup yesterday. I finally pulled the trigger and shorted SPY today after the Fed decision. I think inflation is going to be the undoing of this market.

Tim,

The hat trick of NKE ORCL and RIMM was in our weekly update and our members got to participate in all three. The upcoming earnings season will be another stellar one buy not up to the standards of this bull..you will probably get your 8% correction by summers end and the markets will trend back down to 1490 or so before thye bounce short term

Tom

TTT

Andrew,

The platform I use for this blog is (obviously...) blogger.com

But I'm glad you asked, because I'm toying with another platform (not that I'm unhappy with blogger; I'm just experimenting).

Could you guys go to

and give me any thoughts?

I went to search “Rimm target price” and I found trading goddess at the top of the google search page ....

http://www.google.com/search?hl=en&lr=&safe=off&q=rimm+target+price&btnG=Search

how does this happen?

zee

and i'll check CVH ....

and XLE looks like it'll top out very soon...sometime next week, if not already...

LOVE Typepad. The chart size makes a big difference. I like Blogger too, but Typepad is better...

BTW, I have no idea how it happened, but I am apparently now a daytrader. I've always frowned upon the practice, but I've been very successful trading intraday index options.

Anyone have any sage words of caution? I am an experienced trader, so nothing pedantic, but anything I might not know about day trading specifically...

Thanks!

no rally, 1490 gonna be breached tomorrow. 1450 is stop 1 - gimme 1400 and I'll do a frickin CRAMER, and bash my skull against any offers down there............PLEASE sell this thing! I'm gonna get scared, as a bull, if this thing goes vertical.

I love tech though. VRSN,AMD (my "value" play,GOOG, RVBD (after a breather), CSCO - i think this group is under owned - everyone is in the materials/industrials

Could you guys go to

and give me any thoughts?

The new site is far better than the current one. hopefully a majority votes for it.

sorry andy, no sale here. i just have a hard time believing someone would fade a FOMC announcement with every dime they had - with options, no less - i could believe it if you just shorted the underlying. and to get the price you claim - you were fading the madness right after the announcement. call me a hater, but thats just stupid. my balls aren't that big - i like to sit down when i trade.

Yeah, I'm kind of inclined to agree. Unless you are trading with an account that is 7 figures or larger, that is an ungodly amount of risk.

As for TypePad - I'd like to hear more comments.

I prefer TypePad it is easy on the eyes and the charts are far more crisp. It has a good overall feel to it.

Typepad looks tight. Much better view of the charts. A++ from me on making the switch. Hopefully, comment section will be as easy to use.

Looks like jblu is forming the right shoulder of an h&s pattern. Inflation and threat of rate hike will drive investors away tommorow. Supposed to be quarterly options expiration tommorrow interest for qqqq supposed to balance out around 47+. Bulls time to lose- again

typepad is great. never used it, but i like what i am seeing so far. the bigger charts are really nice. as for the font size, i guess the size is technically the same as blogspot but with the larger charts they have an appearance of being a little smaller. maybe consider bumping it up a point or two just to see how that looks on the eyes. just a sug. have fun

The charts are bigger on the Typepad site simply because that 'theme's' layout is wider. I'm not familiar with how Blogger works, but any blog software that will allow you to adjust the width of the content would do the same.

I use Wordpress on my own host. There are tons of 'themes' available in the public domain for WP - some are fixed width, and others are 'fluid' width, in that they allow the content to occupy the entire screen width.

The biggest charts on Typepad are definitely a plus, but apart from that I like more the blogger interface (fonts, general appearance).

I loved the slope of hope graphics. Two thumbs up.

I bought DXD @ 49.99 (sounds like a sale price) and DIA Jul 136 puts @ 1.35. I daringly bought my puts at market (I never do that!) PRIOR to the Fed. OF course they got cheaper, but then they moved up. I'm expecting calamity--the savior? Spectacular corporate earnings. But let me ask you this...If the economy is in the drechts, how can corporate earnings be but so great.

I had a wonderful (albeit minuscle compared to Andrew)success today. I was so happy with my MLHR puts which I bought yesterday. I was following my SCS short and saying, "Hmmm, when is MLHR reporting?". Well it happened to bet the very next day. I didn't make $75K, but I did make 200% on a $1,450 investment and that was a wonderful risk/reward for moi! (I'm not bragging--just feeling a bit celabratory; I've been straightforward about my kaput puts here as well!)

tim you may like wordpress...

GDP numbers tomorrow, gotta love economic releases.

Then earning season!

ASIA

RRST

working well here.

Anybody have any thoughts on MON? Monsanta.

Your wife in that top pic scares me tim, you can do so much better with a real hot brunette.

I mean Monsanto

Tim,

What kind of behavior usually happens around 4th of July? Is it typically bullish on low volume before and sell-off after? Or...?

mspec,

GDP (Q1 'final') was out this morning. 0.7%, up from the previous 0.6%. But the inflation figures were not comforting to those who continue to try to hide it.

Perhaps it means nothing, but I noticed that the Dow put in a doji today (13422.2770) almost exactly in the same spot as the one on June 11 (13424.9600). In both cases it was on a bounce up to the 13day EMA from basically the same point. The previous doji led to a retest of the lows followed by the double top. It does appear that we may be facing another test of that support at the low yesterday around 13250.

As for the holiday next week, who can say what it brings, besides low volumes. If we take out yesterday's lows tomorrow, or even get in the vicinity, it makes the bear job much easier on low volume next week.

"What kind of behavior usually happens around 4th of July? Is it typically bullish on low volume before and sell-off after? Or...?"

Dunno. Someone mentioned here recently that it's typically one of the most bullish days of the year. I have no basis to say whether it is or isn't.

I can only say it's a short day! The market is going to close early on the 3rd.

Folks, please don't short this thing until next week. The two days preceeding the 4th of July holiday are among the strongest of the year. Short into that rally, not before. Tuesday looks like the perfect day.

I won't be shorting but Glen is right the market is normally very strong leading into the 4th of July. If you're going to short why not just wait for the market to close below the June lows before you jump in? Haven't we learned out lesson yet about picking tops? It has been an awfully expensive lesson over the last year.

4 Profit: Monsanto is my largest holding in my long term IRA. I've had it for almost three years now. I'm a true believer in what they're doing, and will be holding for my grandchildren. Right now, to be honest, I think it's a bit frothy, but, this is like Buffet buying Coke in the 1970's for me. Who cares what it does in the short term?

"The Microsoft of agrotech engineering" is not ridiculously hyperbolic, I don't believe.

Typepad looks great. I like that the comments appear on the same page (tested a sample post for fun). How much control is there over who can post? The rolling hills don't do Slope of Hope justice though--maybe a rock climber on a mountain face dangling from a rope. I could actually almost see the pix of Tim with pigtails in the upper corner. Tim, you are way too close to SF out there on the peninsula. Although I'm not sure how well you'd fit in at the Mother Ship in SLC either...I bet you get along great with the TOS gang in Chicago but winter in the upper Midwest would be unbearable for me. Those TOS folks seem pretty wild.

Who's planning on going to the Money Show in SF in July? Tim are you going to be in a booth or speaker or something?

I will be close to flat over the holiday--in the mountains for two weeks, probably without Internet access. Just make sure there is some action when I come back, OK?

Monsanto is doing some interesting stuff with swine breeding using genetic engineering technology from a Davis, CA lab of MetaMorphix. Apparently, they just introduced two new breeds that should increase farm profits and fatten their purse concurrently.

(I'm trying the embedded link thing for MetaMorphixInc.com so hopefully it works!)

I just drove by the Palo Alto Apple Store with my wife. Lord almighty, all the lunatics are out (along with Scoble, Diggnation, Bill Atkison, and other Valley luminaries).

I plan to get a JesusPhone tomorrow, but by the time I get in line, it'll be backed up to Menlo Park. Sheesh.

"no rally, 1490 gonna be breached tomorrow. 1450 is stop 1 - gimme 1400 and I'll do a frickin CRAMER, and bash my skull against any offers down"

And life comes to end, sky is falling. Seriously RIMM kicked butt today. NIKKEI is up 1+% today. Futures are up overnight. Market chould go up till 4th July.

I was flipped upside down last night...having a 7mo old doesn't make much time for a lot of things...

Tim, MIDD looks like a nice short. If you mentioned it already, sorry for the duplication.

Love the bigger charts. Don't like the leafy tree hill thing, put your new header up there and it will be sweet.

Solar stocks just keep on chugging along.

TSL is on fire!

$90 soon. Too cheap to ignore any longer.

A couple of remarks:

(a) I really appreciate the input on the browser platform; wow, honestly, I didn't know people cared! It's especially encouraging since I just tossed up the Typepad stuff without much trouble.........it would be a lot better with some effort.

(b) I think the entire "short into the 4th" thing is intriguing and fairly convincing. I think this is the kind of debate/information that is what comments section should be about - - the community of readers having a healthy debate about an idea.

jakegint & AssetStrategists- thanks for the info on Monsanto. I appreciate it!

The don't like about this site is this box we're in. Whenever someone embeds a link (which is helpful), you cannot expand the box to see the whole page (which is not) and further, you cannot return to the box without reclicking in again.

Is there any way to fix that part of it?

I just drove by the Palo Alto Apple Store with my wife. Lord almighty, all the lunatics are out (along with Scoble, Diggnation, Bill Atkison, and other Valley luminaries).

I plan to get a JesusPhone tomorrow, but by the time I get in line, it'll be backed up to Menlo Park. Sheesh.

You can always order it online and get it delivered in just 1 few days, the online store also opens 6.00pm today.

For the short crowd check out the chart on IYH.

Thanks Geoff!

The stock market is quite tricky and I can't understand either when it goes down and up. So risky to invest money base on the stock market value. DUB turbo

Post a Comment