Talk About the Weather

I've always felt a bit sorry for meteorologists here in the San Francisco Bay Area. Because, between about April and October, they really have very little to say. The forecast is, more or less, as follows: "There will be patchy morning fog, clearing by late morning. Highs on the coast will be in the lower to mid 60s, with lower to mid 70s around the Bay and low 80s farther inland." It varies little from day to day, week to week, month to month. No rain. No hail. No nothing.

I'm starting to feel a bit like that about the markets these days. "Horrible economic news was reported to me. The markets rallied on the news to historic new highs. Bearish patterns were laid waste."

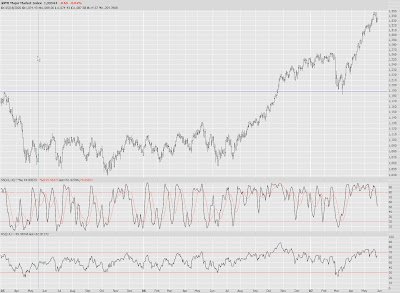

Oh, well. At least we didn't go up another 120 points today. The economy came in with the weakest numbers since 2002, and the Dow was basically unchanged. Looking at the RSI and slow stochastic, you can see how the market is seeming awfully tired, in spite of the progression in prices.

Much the same can be said of the S&P 500 ($SPX).

I was distraught at all the gorgeous real estate head & shoulders patterns getting trounced yesterday, but maybe there is hope yet. Apartment Investments (AIV) is no longer a perfect H&S, but today's weakness is a good sign.

I haven't posted American Airlines (AMR) in a while, but this is a head and shoulders pattern which remains cleanly intact with what appears to be a nice retracement to the neckline in progress.

JC Penney hasn't completed its pattern yet, but - - - it could! Keep an eye on it.

A lot of investment banks seem exhausted lately, whether you look at GS, LEH, or any of many others. Here is Morgan Stanley (MS), which seems to have made a bit of a double top.

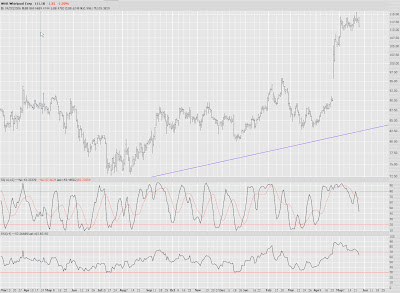

Whirlpool (WHR), a Dow 30 component, is very lofty right now. This seems to me a short with an attractive risk/reward ratio.

And the Big Oil stocks - Exxon Mobil (XOM) is a favorite of mine to watch - likewise have an attractive risk/reward ratio for shorting right now.

There's a ton of economic news tomorrow morning. Let's see if June gets off to a better start for the bears than May was.