The first trading day after Christmas - Tuesday the 27th - was anticipated since people felt the Santa Claus rally would finally kick in, shoving the Dow cleanly over the 11,000 mark and giving 2006 a good rolicking start.

It looked that way at first. Early indications of holiday sales were quite strong, and the Dow swiftly moved up about 50 points. And then the same "rally....then fade" pattern took hold. After reversing 156 Dow points, the Dow finally closed with a triple digit loss. And it is once again in negative territory for the year 2005.

We have three days - 19.5 trading hours, to be precise - left in the year. As I've mentioned numerous times, closing below 10,783 on the Dow by year's end would break the never-before-broken Decennial pattern (for years ending with the digit five).

We are just a hair beneath 10,783 at this point, so it's way too soon to call. But I don't think I'm going out on a limb here by saying that - - after ten failed attempts to break 11,000 over the past month - - odds are that we're going to stay on this side of 11,000 and, at most, end the year with a gain so small on the Dow that it would hardly be worth measuring.

I've started to notice an interesting phenomenon lately, which is that many of the brightest shining stars have started to weaken considerably. Indeed, even when the Dow was up 50 points on Tuesday, one of the hottest performers of the year, NutriSystem (NTRI) was down a full 10% (which meant the puts I owned on it were up well in excess of that).

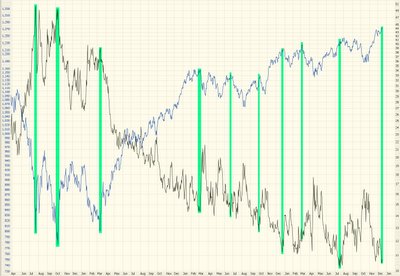

Shorting these momentum stocks can be risky business, but let me point to a recent example that was a pretty clean trade - Forward Industries (symbol FORD). Here's what the stock looked like over the past year or so. Notice this important fact - - although the stock was pushing higher, the momentum was clearly slowing.

I've circled the ascending highs to try to make this point more clear. I've also drawn a sharply ascending trendline to illustrate how its role as support plainly changed to resistance, thus indicating that at least the "straight up" direction of the stock was slowing down.

When I saw this stock a couple of months back, I was intrigued. What kind of business is this? I did a bit of research and found they were in the business of - - hold on to your hat - - cell phone covers. You know, like cases. I was floored. I don't pretend to know anything about that business, and I couldn't argue with the success of the company, so they must have been doing great. But cell phone covers? Was that really a rock solid high-growth business with high barriers to entry?

I kept an eye on the stock, and when it made another thrust upward, I shorted it. I've put a circle on the chart below to indicate where I went short the stock.

A few days back, FORD announced revised expectations, and the price just swooned. You can even make out a pretty decent head and shoulders pattern. My point here is that waning momentum on a former high flier can make for a great short.

Some other high fliers (which may or may not turn out to be great shorts......only time will tell) including GOOG, HANS, WFMI, and, as I mentioned before, NTRI.

NTRI, shown below, has had a huge run up. If the broad market continues to weaken as it has been, and this stock doesn't regain its momentum, a trade like this could be a terribly profitable short, particularly if you're willing to take on the even greater risk of owning a put option position instead of a straight equity short.

I'll be sure to put up a post shortly after Friday's close to find out if the Dow wound up in the plus or minus column this year. It's going to be a photo finish!