Markets Are Getting More Bearish

This old bear is starting to like what he sees. High-flying retail stocks are collapsing. Soaring energy costs are hampering growth. And all the broad indexes are starting to show real fatique. The past 23 years have been by and large an uninterrupted bull run, and it seems times are changing.

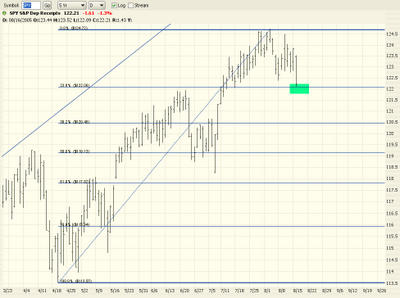

Let's take a look at some recent action among the major indices. What's interesting about each of these (and the examples I'm using are two ETFs, SPY and QQQQ, plus the Dow 30) is their relationship to Fibonacci retracements. All of them touched retracement levels yesterday (August 16) which suggests they will probably pause (or even go up) before piercing these levels to seek lower prices later. Here's the SPY:

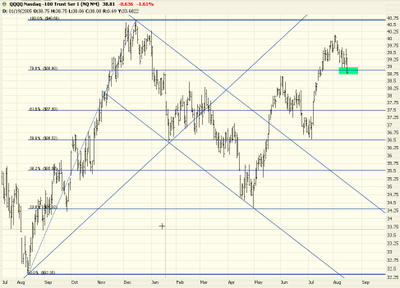

And the QQQQ....(for newcomers, remember clicking on any image brings up a much larger image).

Lastly, the Dow 30 Industrials:

If I haven't been clear enough already - - in the coming months and years, I anticipate a bear market that will make 2000-2002 look like a walk in the park. I am looking for thousands of points erased from the Dow. The "turning of the tide" we have been witnessing recently is the last gasp of the recovery in prices we have witnessed from October 2002 into the middle of this year.

No comments:

Post a Comment